In recent years, we have witnessed a significant shift in the way commerce is conducted, particularly with the emergence of cryptocurrency-only marketplaces. These platforms operate exclusively on digital currencies, allowing users to buy and sell goods and services without the need for traditional fiat currencies. This innovative approach to trade has not only attracted tech-savvy consumers but has also opened up new avenues for businesses looking to tap into the growing digital economy.

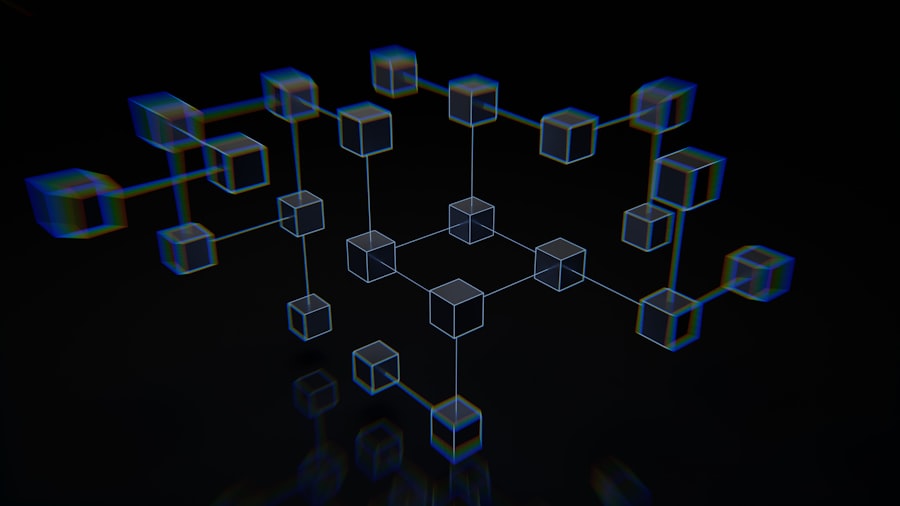

As we delve deeper into this phenomenon, we will explore how these marketplaces function, the role of Bitcoin as a primary currency, and the implications for global trade. Cryptocurrency-only marketplaces represent a radical departure from conventional trading systems. They leverage blockchain technology to facilitate transactions, ensuring transparency and security while minimizing the need for intermediaries.

This decentralized nature of cryptocurrency transactions appeals to many users who value privacy and autonomy in their financial dealings. As we navigate through this article, we will examine the rise of Bitcoin within these marketplaces, its advantages and challenges, and its broader impact on global commerce.

Key Takeaways

- Cryptocurrency-only marketplaces are gaining popularity as a platform for trade and commerce.

- Bitcoin has emerged as a dominant force in facilitating transactions within cryptocurrency-only marketplaces.

- The advantages of using Bitcoin in cryptocurrency-only marketplaces include lower transaction fees and faster cross-border transactions, but challenges such as price volatility and regulatory uncertainty persist.

- Bitcoin’s impact on global trade and commerce is significant, as it offers a decentralized and borderless payment system.

- Security and regulation are crucial factors in Bitcoin transactions, and advancements in technology and regulatory frameworks are shaping the future of Bitcoin trade facilitation.

The Rise of Bitcoin in Trade Facilitation

Bitcoin’s Rise to Prominence in Trade Facilitation

Since its inception in 2009, Bitcoin has emerged as a leading cryptocurrency, largely due to its pioneering status and widespread recognition. Its decentralized nature and limited supply have contributed to its appeal among traders and consumers alike.

The Power of Decentralization

The ability to transact without relying on banks or government institutions has empowered individuals and businesses to engage in commerce on their own terms. Moreover, Bitcoin’s growing acceptance among merchants has further solidified its position in cryptocurrency-only marketplaces. Many online retailers now accept Bitcoin as a form of payment, recognizing the potential for increased sales and customer engagement.

Mainstream Adoption

This trend has been fueled by the increasing number of cryptocurrency wallets and exchanges that make it easier for users to acquire and spend Bitcoin. As a result, Bitcoin has become a viable alternative to traditional currencies, enabling users to conduct transactions across borders with relative ease.

A New Landscape of Commerce

As we continue to analyze the role of Bitcoin in trade facilitation, we will uncover how its unique characteristics have transformed the landscape of commerce. With its growing acceptance and ease of use, Bitcoin is poised to continue playing a significant role in shaping the future of trade.

Advantages and Challenges of Using Bitcoin in Cryptocurrency-Only Marketplaces

The advantages of using Bitcoin in cryptocurrency-only marketplaces are manifold. One of the most significant benefits is the reduced transaction fees compared to traditional payment methods. By eliminating intermediaries such as banks and credit card companies, Bitcoin transactions can be processed at a fraction of the cost.

This cost-effectiveness is particularly appealing for small businesses and entrepreneurs who may struggle with high fees associated with conventional payment systems. Additionally, the speed of transactions is another advantage; Bitcoin transfers can be completed within minutes, regardless of geographical location. However, despite these advantages, challenges persist in the adoption of Bitcoin within these marketplaces.

One major concern is the volatility of Bitcoin’s value, which can fluctuate dramatically over short periods. This unpredictability can create uncertainty for both buyers and sellers, making it difficult to establish stable pricing for goods and services. Furthermore, the lack of regulatory oversight in many jurisdictions raises concerns about fraud and security.

As we delve deeper into these challenges, we will explore how they impact user confidence and the overall viability of Bitcoin as a mainstream currency.

Impact of Bitcoin on Global Trade and Commerce

The impact of Bitcoin on global trade and commerce cannot be overstated. By facilitating cross-border transactions without the need for currency conversion or lengthy processing times, Bitcoin has effectively democratized access to international markets. This newfound accessibility allows small businesses in developing countries to reach customers worldwide, leveling the playing field in a way that was previously unimaginable.

As we consider this impact, it becomes clear that Bitcoin is not just a currency; it is a catalyst for economic empowerment. Moreover, Bitcoin’s influence extends beyond individual transactions; it has the potential to reshape entire supply chains. By utilizing blockchain technology, businesses can track products from origin to destination with unparalleled transparency.

This traceability not only enhances trust among consumers but also streamlines operations by reducing inefficiencies. As we analyze these developments further, we will uncover how Bitcoin is driving innovation in global trade practices and fostering a more interconnected economy.

Security and Regulation in Bitcoin Transactions

As we navigate the world of Bitcoin transactions, security remains a paramount concern for users engaging in cryptocurrency-only marketplaces. The decentralized nature of blockchain technology offers inherent security features; however, vulnerabilities still exist. Cyberattacks, hacking incidents, and phishing scams pose significant risks to users’ funds and personal information.

To mitigate these threats, it is crucial for users to adopt best practices such as using secure wallets, enabling two-factor authentication, and staying informed about potential scams. Regulation is another critical aspect of Bitcoin transactions that warrants attention. The lack of a unified regulatory framework across different countries creates uncertainty for businesses and consumers alike.

While some jurisdictions have embraced cryptocurrencies with open arms, others have imposed strict regulations or outright bans. This patchwork of regulations can hinder the growth of cryptocurrency-only marketplaces and create barriers for users looking to engage in cross-border trade. As we explore these security and regulatory challenges further, we will consider potential solutions that could foster a safer environment for Bitcoin transactions.

Case Studies: Successful Trade Facilitation with Bitcoin

To illustrate the potential of Bitcoin in trade facilitation, we can examine several case studies that highlight successful implementations within cryptocurrency-only marketplaces. One notable example is Overstock.com, an online retailer that began accepting Bitcoin as a payment method in 2014. By embracing this digital currency, Overstock not only attracted a new customer base but also positioned itself as a pioneer in the e-commerce space.

The company’s experience demonstrates how integrating Bitcoin can enhance brand visibility and drive sales. Another compelling case study involves local farmers’ markets that have adopted Bitcoin as a means of payment. In regions where traditional banking services are limited or inaccessible, farmers have turned to cryptocurrency to facilitate transactions with customers.

This approach not only empowers local producers but also fosters community engagement by providing an alternative payment method that aligns with their values. As we analyze these case studies further, we will uncover valuable insights into how businesses can leverage Bitcoin to enhance trade facilitation.

Future Trends and Innovations in Bitcoin Trade Facilitation

As we look ahead to the future of Bitcoin trade facilitation, several trends and innovations are poised to shape its trajectory. One emerging trend is the integration of artificial intelligence (AI) and machine learning into cryptocurrency marketplaces. These technologies can enhance user experience by providing personalized recommendations and improving fraud detection mechanisms.

Additionally, advancements in payment processing technology may lead to faster transaction times and lower fees, further incentivizing users to adopt Bitcoin as a primary currency. Another promising development is the rise of decentralized finance (DeFi) platforms that leverage Bitcoin for lending and borrowing purposes. By enabling users to earn interest on their Bitcoin holdings or access loans without traditional credit checks, DeFi platforms are democratizing financial services and expanding opportunities for individuals worldwide.

As we explore these future trends further, we will gain insight into how innovations in technology will continue to drive the evolution of Bitcoin trade facilitation.

The Potential of Bitcoin in Transforming Trade across Cryptocurrency-Only Marketplaces

In conclusion, the potential of Bitcoin in transforming trade across cryptocurrency-only marketplaces is immense. As we have explored throughout this article, Bitcoin offers numerous advantages that can enhance efficiency, reduce costs, and democratize access to global markets. While challenges such as volatility and regulatory uncertainty remain, ongoing innovations in technology and security measures hold promise for overcoming these obstacles.

As we move forward into an increasingly digital economy, it is clear that cryptocurrency-only marketplaces will play a pivotal role in shaping the future of commerce. By embracing Bitcoin as a primary currency for trade facilitation, businesses and consumers alike can unlock new opportunities for growth and collaboration on a global scale. Ultimately, our journey into this dynamic landscape reveals that Bitcoin is not merely a financial instrument; it is a transformative force poised to redefine how we engage in trade across borders.

In a recent article on NFT Newsletter, the potential of Bitcoin in trade facilitation across cryptocurrency-only marketplaces was explored. The article delves into the impact of Bitcoin on the digital economy and how it is revolutionizing the way transactions are conducted in these marketplaces. For more insightful articles on cryptocurrency and blockchain technology, visit 10 simple tips to improve your test-taking skills.

FAQs

What is Bitcoin?

Bitcoin is a decentralized digital currency, without a central bank or single administrator, that can be sent from user to user on the peer-to-peer bitcoin network without the need for intermediaries.

What is trade facilitation?

Trade facilitation refers to the simplification, standardization, and harmonization of international trade procedures in order to reduce transaction costs and improve efficiency.

What is a cryptocurrency-only marketplace?

A cryptocurrency-only marketplace is an online platform where goods and services are bought and sold using only cryptocurrency as the medium of exchange, without the involvement of traditional fiat currencies.

How does Bitcoin facilitate trade across cryptocurrency-only marketplaces?

Bitcoin facilitates trade across cryptocurrency-only marketplaces by providing a secure, decentralized, and efficient means of conducting transactions without the need for traditional financial intermediaries.

What are the benefits of using Bitcoin in trade facilitation?

Some benefits of using Bitcoin in trade facilitation include lower transaction costs, faster settlement times, increased security, and the ability to conduct cross-border transactions without the need for currency conversion.

What are the challenges of using Bitcoin in trade facilitation?

Challenges of using Bitcoin in trade facilitation include price volatility, regulatory uncertainty, scalability issues, and the potential for illicit activities due to the pseudonymous nature of Bitcoin transactions.