NFTs, or non-fungible tokens, have swept the digital world in recent years. These distinctive digital assets are becoming in demand, drawing in investors, collectors, & artists alike. With artists and creators releasing limited edition NFTs to the public, NFT drops in particular have attracted a lot of attention. You’ve come to the correct place if you want to take part in these drops but are new to the world of NFTs. The goal of this blog post is to offer a thorough explanation of NFT drops and successful navigation techniques.

Key Takeaways

- NFTs are unique digital assets that can represent anything from art to music to virtual real estate.

- Owning NFTs can provide benefits such as exclusivity, ownership, and potential financial gain.

- To participate in NFT drops, you need to have a digital wallet and be prepared to bid or purchase quickly.

- Some of the top NFT drops to look out for include NBA Top Shot, CryptoPunks, and Bored Ape Yacht Club.

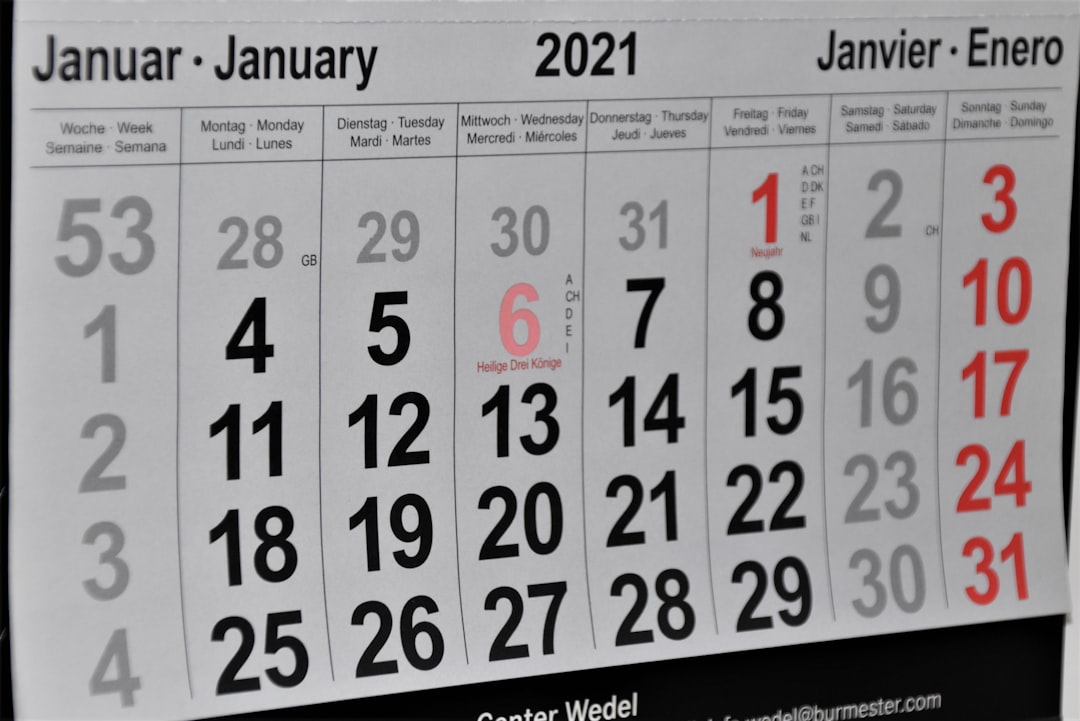

- The NFT Drops Calendar is a comprehensive guide to upcoming drops and can help you stay up-to-date with the latest trends in the NFT market.

It’s important to comprehend what NFTs are and why they’re so important in the digital world before getting started with NFT drops. One blockchain, usually the Ethereum blockchain, is where NFTs, or unique digital assets, are kept. NFTs cannot be exchanged for other cryptocurrencies on a like-for-like basis, in contrast to fungible cryptocurrencies like Bitcoin and Ethereum, which can be exchanged one-to-one. The significance of NFTs resides in their capacity to serve as digital equivalents of ownership & authenticity. Digital works of art, music, videos, and virtual real estate can all be tokenized by creators and sold as exclusive assets with NFTs. This eliminates the need for middlemen and enables artists to directly monetize their work.

Because each token is distinct & cannot be duplicated, NFTs also offer a degree of scarcity. Significantly raising the value and significance of these digital assets have been some of the most costly NFT sales to date. For instance, Beeple’s digital piece of art “Everydays: The First 5000 Days” fetched an incredible $69 million at auction. This sales record not only demonstrated the potential financial worth of NFTs, but it also elevated them to a general public awareness. The benefits of owning NFTs are numerous and draw in investors and collectors.

First of all, you become the owner of a special digital asset when you possess an NFT. The ownership of this property is documented on the blockchain, offering an unchangeable and transparent evidence of ownership. This is especially beneficial for artists because it gives them ownership over their works and guarantees that they will be fairly acknowledged & paid for their contributions.

Besides, NFTs offer an authenticity level that the digital world frequently lacks. Finding the original source or veracity of a digital file has grown more challenging with the popularity of digital art and media. By offering a traceable and verifiable record of ownership, NFTs ensure that the creator’s work is acknowledged and protected, thereby solving this problem.

NFTs can be used for investment purposes in addition to ownership and authenticity. NFTs have the potential to increase in value over time, much like traditional artwork or collectibles. As a result, there is a growing market of NFT investors and collectors who are hoping to make large returns on their capital. Early adopters have made significant profits from several successful NFT projects, like NBA Top Shot and CryptoPunks, which have seen a sharp increase in token values.

To take part in NFT drops, you need to be prepared & have a basic understanding of the procedure. Find out which NFT project interests you by doing some research beforehand. In order to do this, one must study the artist’s earlier creations, comprehend the idea underlying the NFT, & assess its possible worth. Investing in projects that are both strongly supported by the community and that fit your interests is important.

Establishing a digital wallet that accepts NFTs is necessary after you’ve chosen a project. MetaMask is the most widely used wallet for NFTs. It is an Ethereum blockchain-interactive browser extension.

Ether (ETH), the cryptocurrency used for Ethereum network transactions, must be deposited into your wallet after it has been set up. You must be ready to move fast when the NFT drop is announced. The moment an NFT drop goes live, you need to be prepared to buy because they frequently sell out in a matter of minutes. This could entail checking for updates on the drop time on the project’s website or by following them on social media.

It’s crucial to remember that there are scams and fraudulent projects in the NFT drop industry, and not all of them are genuine. Doing extensive research on the project and the team behind it is essential to avoiding becoming a victim of these scams. Look up details about the creators, their past endeavors, and any affiliations or partnerships they might have. Projects that make exaggerated returns promises or employ deceptive marketing strategies should also be avoided.

The NFT market is dynamic, with new drops and projects being announced on a regular basis. The most eagerly awaited NFT drops of the year are listed below:1. Artists can produce generative art projects on the Art Blocks Curated platform. Every project is made up of a collection of original works of art that are produced by algorithms. Collectors are anxious to get their hands on these unique pieces of art, and the next drops on Art Blocks Curated are expected to be extremely popular. 2.

Ten thousand distinct Bored Ape NFTs make up the Bored Ape Yacht Club. Every NFT depicts an ape with unique characteristics & accessories. The NFTs have grown in value and demand, and the project has seen substantial growth in popularity. 3. World of Women is an anthology of 10,000 distinct NFTs that honor women in various spheres of life.

Through art and storytelling, the project seeks to uplift and empower women. Because of their varied cast of characters and stories, NFTs are extremely sought-after collectibles. Numerous NFT drops calendars are available online to aid in navigating the world of NFT drops. A detailed schedule of forthcoming NFT drops is offered by these calendars, along with information about the project, the release date, & login links.

A calendar like this is the NFT Drops Calendar, which attempts to serve as a one-stop shop for fans of NFT. The NFT Drops Calendar has been designed with ease of use and navigation in mind. It gives users a concise summary of forthcoming drops and lets them filter by popularity, project type, and date. Every listing contains all the pertinent details about the project, including the artist, the idea, and any noteworthy elements.

In order to facilitate participation in the drop and provide access to additional information, the calendar also includes links to the project’s website and social media accounts. In particular for newcomers, navigating the NFT market can be difficult. To assist you in making wise investment decisions and avoiding typical blunders, consider the following advice:1. Conduct Your Research: Spend some time learning about the project and the team behind it before making an investment in an NFT project. Look up the creators’ background, their prior work, and any affiliations or partnerships they might have.

To further grasp the potential of the project, read evaluations and thoughts from reliable sources. 2. Establish a Budget: NFTs can be costly, and it’s simple to get carried away by the thrill & go over budget. Make a spending plan for yourself and follow it. You can make sure you’re investing within your means & prevent impulsive purchases by doing this. 3. Diversify Your Portfolio: It is crucial to diversify your NFT portfolio, just as you would with traditional investments.

Invest in a range of artists and projects to diversify your portfolio and boost your chances of success. 4. Remain Up to Date: New projects & trends are appearing on a regular basis, and the NFT market is always changing. Make educated investment decisions by keeping abreast of the most recent news & advancements in the NFT industry. Participate in conversations with other enthusiasts, follow reliable NFT news sources, & join NFT communities.

Think about signing up for an NFT newsletter to be updated on the newest drops and trends in NFT. Updates on impending drops, project launches, and industry news are regularly provided by these newsletters. They frequently contain exclusive material, artist interviews, and advice from professionals in the field. Staying up to date and making sure you don’t miss out on any exciting opportunities can be achieved by subscribing to an NFT Newsletter.

It’s a great way to get knowledge about the NFT market & hear from seasoned investors and collectors. NFTs have a bright future ahead of them and have the power to completely transform a number of industries. The following are some trends and predictions to keep an eye on:1. Integration with Virtual Reality (VR): By enabling users to possess and exchange virtual assets, NFTs have the potential to revolutionize the virtual reality industry. Virtual property, avatars, & in-game goods are a few examples of this. 2.

Real-World Asset Tokenization: Real-world assets, including real estate, high-end merchandise, and intellectual property, can be tokenized using NFTs. It would also make it simpler to transfer ownership of these assets and allow fractional ownership. Three. The gaming & esports industries have already seen a notable increase in the use of NFTs. In addition to rewarding players and facilitating peer-to-peer trade, they can be utilized to produce exclusive in-game items. 4.

Digital Identity and Authentication: Digital assets can be authenticated and digital identities established using NFTs. Digital music, art, and other media have to deal with this in some way. Lastly, NFT drops have drawn the attention of investors, collectors, and artists alike, emerging as a major digital trend.

Possession, authenticity, and investment potential are just a few advantages of owning NFTs. Research, planning, and caution are necessary when participating in NFT drops in order to stay away from fraud and scams. NFT drops calendars & newsletters are helpful tools to help you navigate the world of NFT drops.

They help you stay current with news and trends and offer detailed information about upcoming drops. Staying informed & exploring the potential of these unique digital assets is crucial as the future of NFTs continues to unfold. Thus, if you’re prepared to use NFTs to unlock the future, begin by investigating the NFT drop community & selecting the projects that appeal to you. NFTs provide a fresh and exciting way to interact with the digital world for anyone involved in the arts, collecting, or investing. Happy gathering!

Looking to improve your test-taking skills? Check out this informative article on “10 Simple Tips to Improve Your Test-Taking Skills” from the NFT Newsletter. Whether you’re a student preparing for exams or a professional looking to enhance your performance in assessments, these tips will help you unlock your full potential. Don’t miss out on this valuable resource! Read more

FAQs

What is an NFT?

NFT stands for Non-Fungible Token, which is a unique digital asset that is verified on a blockchain network. It can represent anything from art, music, videos, and even tweets.

What is an NFT Drops Calendar?

An NFT Drops Calendar is a comprehensive list of upcoming NFT releases, including the date, time, and platform where they will be available for purchase.

Why should I care about NFT Drops?

NFT Drops are a great way to invest in unique digital assets that have the potential to increase in value over time. They also allow you to support your favorite artists and creators by owning a piece of their work.

How do I purchase an NFT?

To purchase an NFT, you will need to have a cryptocurrency wallet and be familiar with the platform where the NFT is being sold. Each platform has its own process for purchasing NFTs, so it’s important to do your research beforehand.

What are some popular NFT platforms?

Some popular NFT platforms include OpenSea, Nifty Gateway, SuperRare, and Rarible. Each platform has its own unique features and selection of NFTs.

What are some upcoming NFT Drops to look out for?

Some upcoming NFT Drops to look out for include the Bored Ape Yacht Club, Cool Cats, and Art Blocks. It’s important to do your own research and decide which NFTs align with your interests and investment goals.